Reading time: 5 minutes

Summary: This article is intended to educate homeowners on how the solar investment tax credit works.

As we scale the country towards a future in renewable energy, the US government is offering tax credits to citizens who install solar on their homes. You may have noticed a lot more solar going up in your area in the past 10 years. These people likely received the solar investment tax credit. The good news is, it’s not too late to make the switch yourself! Thousands of homeowners are choosing to own their power, and it comes with the financial incentives of the solar investment tax credit.

A Tax Credit? What is That?

Nobody likes to talk about taxes, let alone try to understand the complexities of the US Tax Code – but we are here to help. A tax credit is a dollar-for-dollar reduction of the federal income tax you owe (or have already paid out of your paycheck). For example, say you owe $1,000 in federal taxes, but also have a tax credit for $1,000. Your credit cancels out your taxes, which means you don’t have to pay anything! If you pay taxes on each of your paychecks, you can even receive the tax credit in the form of a tax refund.

*This is variable by person, income, and other tax liabilities. Please consult a licensed tax professional to determine your eligibility for the tax credit.*

The Solar Investment Tax Credit Explained

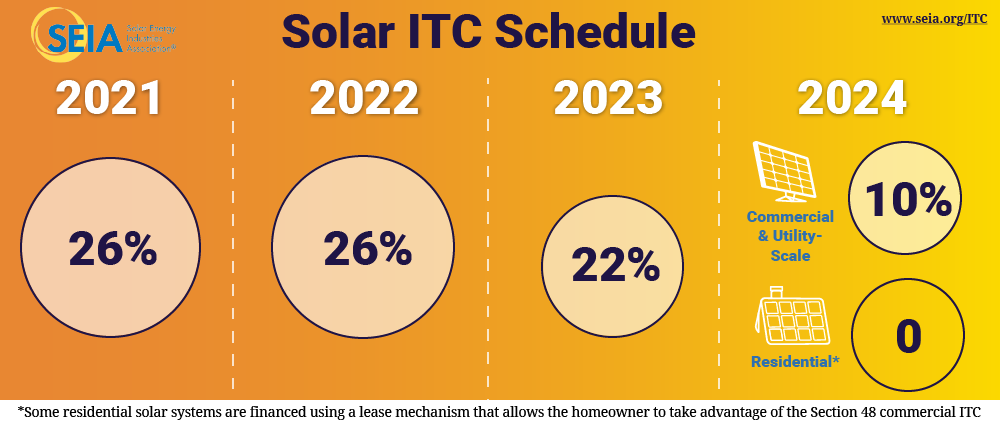

The installation of solar can be expensive, but it is achievable for most homeowners through the Solar Investment Tax Credit (ITC). The ITC was originally established with the Energy Policy Act of 2005. In December 2020, Congress passed an extension of the ITC – which means you still have time to save, but not for long! Currently the tax credit is as follows:

Example: So if Fred buys a solar system for $40,000, he will receive a $10,400 credit towards his taxes in 2022. It decreases to $10,000 in 2023 – and he’ll get nothing in 2024. That’s why homeowners should act now to get the most benefits from going solar. Book a free consultation with us here.

It is important to note that you can only get this tax credit if you buy your system outright or take out a solar loan. The system must be installed on your primary or secondary home. The good news is, there is no limit to the ITC. You can carry it forward for future years if your solar tax credit exceeds the taxes you owe that year. Unfortunately, PPAs (Power Purchase Agreements) and solar leases do not qualify for this incentive.

We have found the best way to get a return on your investment, qualify for the tax credit, and have no upfront cost is through a solar loan. The Solar Investment Tax Credit makes this process much more accessible for homeowners. Investing in solar is the only way to own your power that offers both a return on investment and a positive impact for the planet.

The Best Place to Invest in Solar

There are a lot of solar companies out there, but some are better than others. It is not only important to get an excellent deal on your system price, but also ensure a high-quality installation. That’s where Sustainable Solutions Advisors comes in.

Sustainable Solutions provides transparency and honesty throughout your solar investment – while making your research even easier. If you choose to book a free consultation with us, we will:

- Build you a custom energy report based on your family’s energy usage.

- Discuss upgrades necessary to accommodate your future energy plans.

- Provide fair pricing so you can both save money and add value to your home.

- Connect you with a reputable installer to install your system.

We operate nationwide and offer virtual or in-person consultation appointments. To discover your solar options and receive a design in your home, click here.